Mortgage Reconveyance

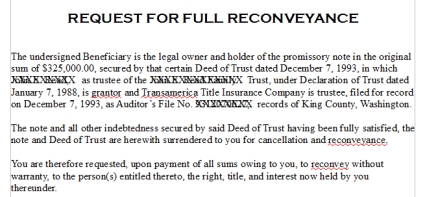

A mortgage is a secured loan, which means it is backed by an asset -- in this case, the house itself. This lowers risk and gives the lender the confidence to make the loan. But secured loans are not always represented by the buyer's word alone. In addition to the mortgage contract, lenders may be able to require extra security, such as the title to the property itself. This exchange and return of title is at the heart of a reconveyance. A reconveyance is a legal process in which the lender gives back the title of the property to the borrower. This occurs when the borrower fully pays off the mortgage. With the mortgage debt gone, the lender has no more claim on the property and must close the account. As part of the closing, the lender relinquishes any claim on the house and transfers the title, which it has been claiming throughout the mortgage, back to the borrower. The borrower becomes the true owner of the property and the lender is able to record a successful mortgage.

No comments:

Post a Comment